Faster invoice processing through automated sorting and information collection

Overcoming the tedious and manual processes in accounts payable

To thrive in today’s fast-paced digital world, traditional internal processes such as accounts payable (AP) are prime for modernisation. That’s because the AP process is usually rife with manual touchpoints and paper documents, which translates to high costs, low visibility and long processing times. These get in the way of business growth and even vendor relationships, especially when the finance department cannot respond to supplier inquiries in time.

Get faster and accurate invoice processing with Accounts Payable Automation

Automate and optimise AP processes with AI-driven data capture, touchless processing and electronic workflow capabilities. These enable enhanced productivity and eliminate errors that occur during AP processing, such as late and duplicated payments. You can also reduce purchase-to-pay process costs with less time spent on manual processing. The end result is a much simpler and more efficient way of managing your business’s cash flow.

Customer satisfaction is closely tied to the accounts receivable process

The accounts receivable (AR) department deals directly with customers and cash collections. However, manual processes often lead to issues such as lengthy invoice disputes, extended Days Sales Outstanding (DSO) times, increased bad debt write-offs and unhappy customers. Employees also devote hours searching for contact information and prioritising customers to call, which taps into resources that can be better devoted to other aspects of collection management.

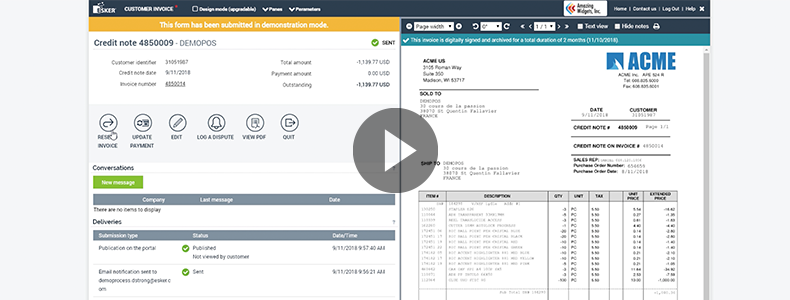

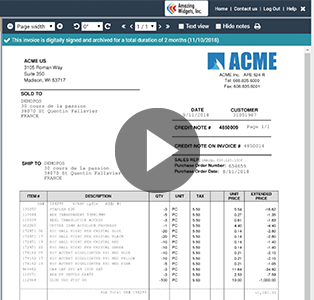

Get paid faster with Accounts Receivable Automation

Deliver and archive customer invoices automatically with Accounts Receivable Automation, which tap on artificial intelligence (AI) to accelerate the AR process and ease invoicing issues, such as dispute resolution. This gives employees the freedom to work on strategic tasks by removing low-value administrative tasks, while still offering businesses the visibility to manage overall performance. By accurately predict the likelihood of payment, businesses can also get better visibility over cash allocation.